By Samuel Njoroge, Esther Mugi-Ngenga, Pauline Chivenge, Hakim Boulal, Shamie Zingore, Kaushik Majumdar

The Covid-19 pandemic and recent geo-political conflict has combined to significantly disrupt the global fertilizer supply chains and cause disproportionate fertilizer price hikes and shortages in Africa. This study assessed the effects of the fertilizer crisis on prices and availability, and the macro- and micro-level responses of stakeholders and farmers in Kenya and Ghana. Fertilizer prices doubled since the onset of the crisis with various interventions implemented at the country, continent, and global levels in response to the crisis, while at the local level farmers adopted a wide range of coping strategies.

Higher fertilizer use is critical to increase crop productivity and attain food security in Africa. Fertilizer nutrient use in sub-Saharan Africa (SSA) is the lowest globally at less than 20 kg ha-1 compared to the global average of 135 kg ha-1. This is largely due to high fertilizer cost, limited production and distribution infrastructure, and low availability, among other factors. For example, fertilizer prices in SSA are at least four times higher than in Europe (Intelligence, 2016), while farmers rarely access fertilizers in an adequate and timely manner due to import and local distribution challenges.

In early 2022, the geo-political crisis in Ukraine worsened global supply chain disruptions initially triggered by the Covid-19 pandemic. Many African countries are dependent on fertilizer imports from Russia, Belarus, and Ukraine. The reduced supply from these regions led to shortages and price hikes, with doubling of fertilizer prices between 2020 and 2022 in many countries like Kenya, Uganda, and Tanzania (Hassan, 2023), further constraining fertilizer use in Africa.

Reduced fertilizer use in SSA has worsened the already poor crop yields and high incidence of food insecurity in the region. For example, the World Food Program (WFP) estimated that cereal production decreased by 16% (year-on-year) in East Africa during the 2022 cropping year, raising the region’s food insecure population by nearly 6-7 million people by the end of 2022 (WFP, 2022). However, severity of the fertilizer crisis and the response of stakeholders and farmers is likely to vary by country and location. To what extent have the prices, availability, accessibility, and use of fertilizer in Africa been affected by the current fertilizer crisis? What were the responses to the fertilizer crisis at the macro-level by various stakeholders? What coping strategies have farmers adopted to mitigate the impact of the fertilizer crisis? These are the questions addressed within this recent impact analysis.

Study description

This study was designed to assess the impact of the fertilizer crisis using primary data collected from Kenya and Ghana and available secondary data across Africa. Primary data on effect and responses to the fertilizer crisis was collected in early 2023 and covers the period from 2019 to 2022. Secondary data on international, and national retail fertilizer prices was accessed from Africa Fertilizer (www.africafertilizer.org) for 2021 and 2022.

Trends in international fertilizer prices

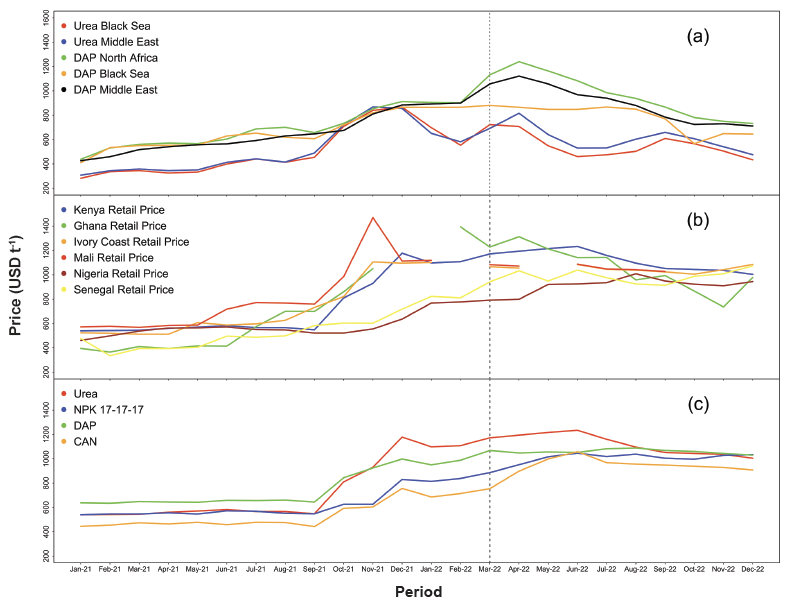

Secondary data on international fertilizer prices for diammonium phosphate (DAP) and urea show steep, short-term increases (Fig. 1a). Initially, prices gradually increased from January to September 2021 with minimal price differences observed among similar products from different origins. During this period, DAP prices were, as expected, consistently higher than those for urea. A sharp increase in the price of urea occurred from November to December 2021, with peak prices above 800 USD t-1. At this point, international prices for urea matched those for DAP. High urea prices at the end of 2021 were followed by a sharp decline in early 2022, before another notable increase immediately after the onset of the geopolitical crisis. This was followed by a significant decrease in prices, some relative stability, and a gradual decline towards the tail end of 2022. Urea prices at the end of 2022 were, however, still substantially higher than prices at the start of 2021.

For DAP, prices also increased gradually from January to September 2021, which was followed by a period of relative stability up to February 2022 (Fig. 1a). The onset of the crisis then caused a sharp rise in the prices of DAP originating from North Africa and the Middle East, reaching peak prices (>1,100 USD t-1) in April 2022 before their gradual decline. On the contrary, DAP prices from the Black Sea region remained stable at about 850 USD t-1 from November 2021 to August 2022, and thereafter declined during the later part of the year. The increased urea prices observed during the same period most likely caused DAP price increases in North Africa, which largely depends on ammonia imports for DAP manufacture. Stable prices for DAP from the black sea region are likely related to the trade restrictions that suppressed demand on fertilizer products from this region following the onset of the geo-political crisis. However, these restrictions likely triggered higher prices for DAP from the other regions due to the reduced total supply.

Trends in local fertilizer retail prices

Monthly urea retail prices in six African countries were used to track changes in national retail prices (Fig. 1b). Urea costs at the start of 2021 were substantially different among countries, with the lowest price per ton recorded in Ghana at USD 395, and the highest in Mali at USD 572. Higher prices in landlocked Mali are most likely related to the lack of access to seaports compared to the other countries.

Cost of urea in all countries remained relatively stable until May 2021 when prices in Mali rose sharply, while those in Nigeria and Kenya remained steady until September 2021 (Fig. 1b). Prices in Senegal, Ghana, and Ivory Coast showed their initial increases in June, August, and September, respectively. Observed price increases in Ghana and Ivory Coast were in line with international trends, while the cost of urea in Senegal were similar to Nigeria, suggesting differences in urea sources between Ghana and Ivory Coast on one hand, and Senegal on the other.

Much like the international trend, urea retail prices increased sharply towards the end of 2021. However, retail prices remained high throughout most of 2022 in contrast to the international trend, indicating a longer time lag in changes in retail prices (Fig. 1a and 1b). Differences in cost of urea between countries were amplified between October 2021 and May 2022, with Ghana, Mali, and Kenya showing markedly higher prices compared to Senegal and Nigeria (Fig. 1b). The urea retail prices in Nigeria, and to some extent in Senegal, appeared not to be affected by the international price increase that occurred after November 2021. For Nigeria, this could be linked to the large urea production capacity, illustrating the utility of local production in countering the effects of global price increases.

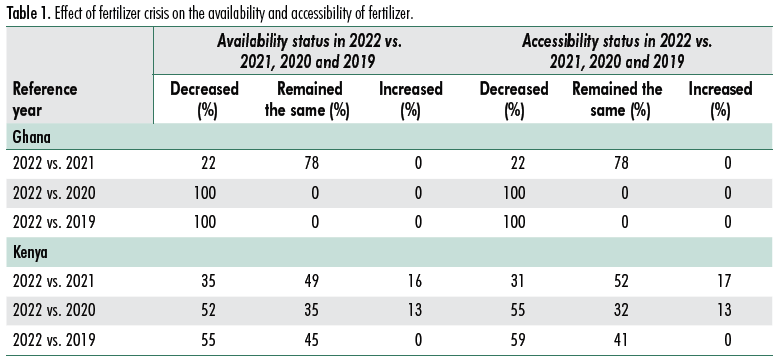

Monthly retail prices for urea, NPK, DAP, and calcium ammonium nitrate (CAN) in Kenya provide short-interval trends in fertilizer retail prices at the national level between January 2021 and December 2022 (Fig. 1c). The cost of all products was stable between January and September 2021 with retail prices ranked as DAP > NPK = Urea > CAN. However, a sharp increase in retail prices was observed from September to December 2021 across all fertilizer types with the highest increase observed for urea, which now had the highest retail price. This period was followed by relative stability from January to June 2022, and by a gradual decline in retail prices towards the end of 2022. However, the cost of all fertilizer products at the end of 2022 was substantially higher than those recorded at the start of 2021. These trends correspond with observations from primary data where cost of fertilizer, on average, doubled between 2019 and 2022 (data not shown). Primary data also showed that higher fertilizer prices were associated with reduced supply of fertilizer, with most farmers reporting that availability and accessibility had decreased in 2022 relative to 2019 (Table 1).

Micro-level responses to fertilizer crisis

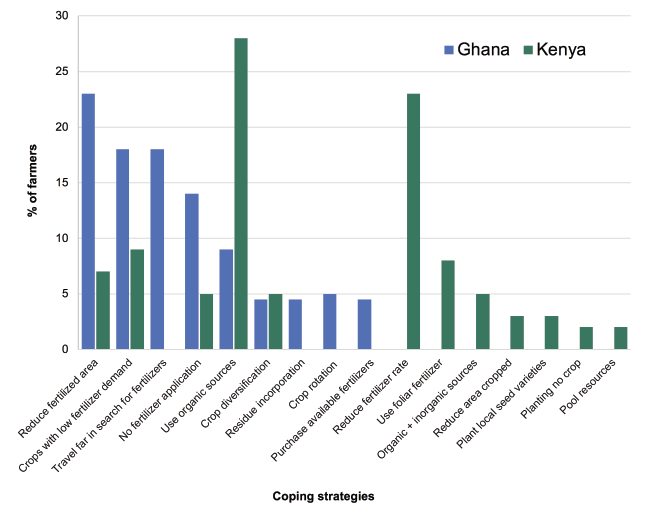

Primary data revealed that farmers adopted various coping strategies to mitigate the impact of the fertilizer crisis (Fig. 2). Strategies common to Kenya and Ghana included use of organic fertilizer sources (9- 28%), reduction in fertilized area (7-23%), growing low fertilizer demanding crops (9-18%), omitting fertilizer application (5-14%), and increased crop diversification (5%). In Ghana, the most popular on-farm strategy (23%) was to reduce the area receiving fertilizer; while in Kenya 28% of farmers increased their reliance on organic nutrient sources.

Macro level responses to fertilizer crisis

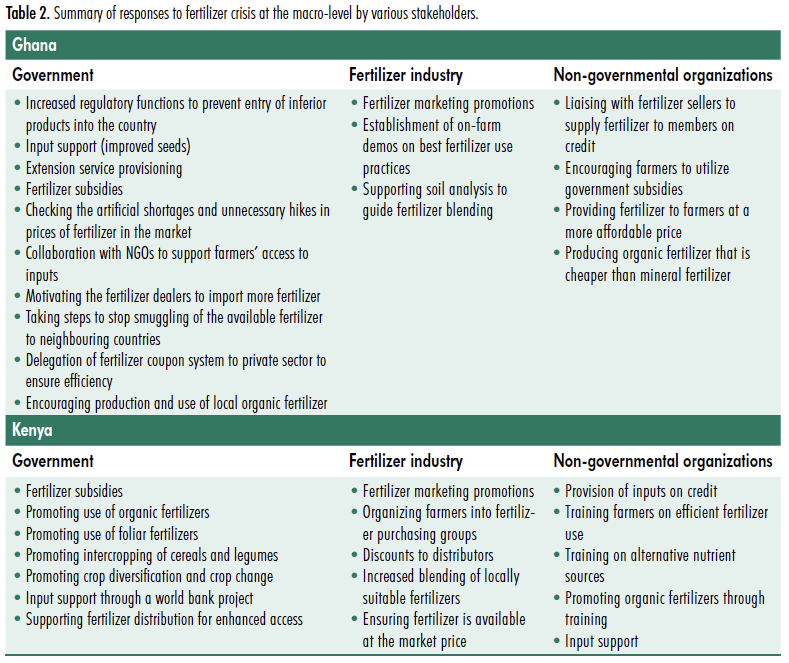

At the macro level, governments, the fertilizer industry, and non-governmental organizations (NGOs) used various interventions to support farmers. These included fertilizer subsidies, promoting the use of organic fertilizer, and joint efforts by government and NGOs to supply fertilizer and seed to farmers (Table 2). Notably, some fertilizer producers (e.g., Sanergy in Kenya), doubled organic fertilizer production in 2022 with the support of USAID.

Looking Ahead

Africa was severely affected by the fertilizer crisis, with sharp increases in prices and short supply because of the heavy reliance on imports. There has been some support in mitigating the crisis. However, the micro and macro level interventions to mitigate the effects of the fertilizer crisis were largely short-term. Subsidies and reduction of fertilizer application rates are likely not sustainable in the long run. There is, therefore, a need for Africa to develop long-term and sustainable solutions to address such disruptions in the future. These include, but are not limited to, increasing Africa’s capacity for fertilizer production which is low and limited to a few countries (www.africafertilizermap.com). However, even the countries with capacity to manufacture fertilizers often source part of the essential raw materials from outside Africa and may therefore not be fully immune from global disruptions. For example, DAP production from Morocco relies on imported ammonia. Investments aimed at enhancing the fertilizer manufacturing capacity of African countries using internal resources can therefore potentially shield local farmers from global supply chain disruptions as we have seen recently. For example, in Nigeria, the lower impact of fertilizer crisis on retail prices of urea as reported in this study can be directly linked to the capacity for local production of urea.

At the continental level, the fertilizer industry has stepped up efforts to make fertilizers more widely available and improve agricultural production on the continent. There are many noteworthy examples including the multi-institutional “Sustain Africa” initiative, a crisis response and resilience initiative aimed at increasing access of fertilizers to smallholder farmers in sub-Saharan Africa (https://sustainafrica-initiative.org), with the ultimate aim of improving the availability, affordability, and effective and sustainable use of fertilizers. The fertilizer industry is also extending immediate support to help farmers tide over the current crisis by making fertilizer available either free of cost or at a greatly reduced cost (https://newafricanmagazine.com/28344; Latrech, 2022). Major international financial and development institutions and governments are also providing support to strengthen and revitalize the fertilizer supply chains in Africa to avoid the fertilizer crisis spiralling into a major humanitarian crisis. In countries like Ivory Coast, Malawi, and Zambia, with limited raw materials, investments are focusing on developing fertilizer blending and granulation facilities. Financial support from global and regional financing institutions such as the World Bank and the African Development Bank is therefore critical for enhancing the capacity for fertilizer production.

Between countries in Africa, access to, and cost of, imported fertilizers are usually further affected by high inland transportation costs, distance from seaports, access to seaports, inefficiencies linked to poor infrastructure, limited access to finance, local regulations on entry in fertilizer markets and fertilizer distribution, among other factors. Policy changes that reduce barriers to entry into fertilizer markets and fertilizer distribution can also help in improving the access to and affordability of fertilizers. The implementation of intracontinental policies, such as the African Continental Free Trade Area (AfCFTA) is expected to improve cross-border trade efficiency and is likely to enhance movement of fertilizers and other goods making them easily available and reducing prices currently caused by cross-border tariffs.

With Africa having more than 65% of the world’s uncultivated arable land, there is potential for the region to become a breadbasket with agricultural transformation. Yet, Africa remains the largest food importer with low crop productivity. Improving fertilizer access and availability can potentially enable Africa to withstand shocks such as those experienced during the fertilizer crisis and become self-sufficient in food production.

Dr. Njoroge is APNI Scientist, Nairobi, Kenya, (e-mail: s.njoroge@apni.net). Dr. Mugi-Ngenga is APNI Associate Scientist, Nairobi. Dr. Chivenge is APNI Principal Scientist, Benguérir, Morocco. Dr. Boulal is APNI Senior Scientist, Settat, Morocco. Dr. Zingore is APNI Director of Research & Development, Benguérir. Dr. Majumdar is APNI Director General, Benguérir.

Cite this article

Njoroge, S., Mugi-Ngenga, E., Chivenge, P., Boulal, H., Zingore, S., Majumdar, K. 2023. The Impact of the Global Fertilizer Crisis in Africa, Growing Africa 2(1), 3-8.https://doi.org/10.55693/ga21.XZVK8042

REFERENCES

Hassan, M.O. 2023. One Year Later, Somalia Still Feeling Effects of Ukraine War. https://www.voanews.com/a/one-year-later-somalia-still-feeling-effects-of-ukraine-war-/6977881.html (Accessed 12 April 2023).

Intelligence, G. 2016. The World’s Most Expensive Fertilizer Market: Sub-Saharan Africa. New York, NY: Gro Intelligence. https://www.gro-intelligence.com/insights/fertilizers-in-sub-saharan-africa (Accessed 11 April 2023).

Latrech, O. 2022. Morocco’s OCP Group Donates 15,000 Tonnes of Fertilizers to Rwanda. https://www.moroccoworldnews.com/2022/07/350306/moroccos-ocp-group-donates-15-000-tonnes-of-fertilizers-to-rwanda (Accessed, April 14 2023).

WFP. 2022. Estimated likely impact of increased fertilizer prices on cereal production in eastern Africa during 2022 cropping year. https://docs.wfp.org/api/documents/WFP-0000140058/download/